If you’re not yet withdrawing your Payoneer funds to your Domiciliary account, you’ve been probably losing hundreds of dollars without knowing it. In this wikifreelancing guide, you’ll learn the simple steps to add your domiciliary account to your Payoneer to withdraw your funds and enjoy a reasonable exchange rate. These steps can also be used to add any type of bank account to Payoneer.

4 Easy Steps to Link Your Domiciliary account to your Payoneer

- Open a domiciliary account

- Log in and click on the ‘Banks and Cards’ menu

- Click on ‘Bank accounts for withdrawal’

- Click on the ‘add new bank account’ and fill out the form

1. Open a domiciliary account

You should have a domiciliary account at this stage. But, if you don’t have a domiciliary account, here’s a detailed guide on everything you need to know about the domiciliary account; requirements, types, limitations, and how to load or withdraw your funds from your domiciliary account.

[ads]» MORE: Everything You Need To Know About Domiciliary Account

Log in to your Payoneer and go to the dashboard. Then, find and click on the “Banks and Cards” option from the menu.

3. Click on Bank accounts for withdrawal

On the ‘Banks and Cards’ page, there are three cards

- Bank accounts for withdrawal

- Receiving accounts and

- Payoneer cards

Click on the first card, Bank accounts for withdrawal, since you want to link your domiciliary bank account to withdraw your funds.

If you’ve added a bank account previously, whether domiciliary or not, it’ll appear on the ‘Bank accounts for withdrawal’ page.

However, keep in mind that you can only add a maximum of 3 different bank accounts in total. But if you want to add more bank accounts later, you would have to delete any of the 3 bank accounts to add the new account.

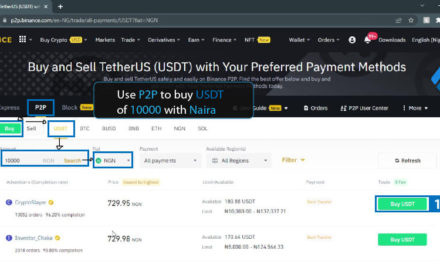

[ads]» MORE: Two Best Ways To Buy Dollars or USDT via Black Market and Binance

4. Click on “add new bank account” and fill out the form

On the ‘bank accounts for withdrawal’ page, click on the “add new bank details and fill out the form with your domiciliary account bank details. Here’re the details to fill in:

- Account type (e.g. personal)

- Account currency (e.g. USD, NGN)

Click on the next button to add more details:

- Name of the bank from the dropdown

- Account number

- Checkboxes for terms and confirmation

Click on the next button to fill out the final data:

- Date of birth

- Payoneer password

Finally, click on the “Add Bank Account” button, and you’ll get a message indicating that you’ve successfully added your bank account to Payoneer.

How long does it take to approve my bank account on Payoneer?

After adding your bank account successfully, Payoneer will always display that they will approve your bank account within 30 minutes;

[ads]Account approval usually takes up to 30 minutes. We’ll email you when you can start withdrawing to this account.”

Payoneer

However, this is valid only if you’ve added and verified a bank account on Payoneer previously. Therefore, if it’s your first bank account on Payoneer, it may take 3 business days to get approved and verified.

Now, when you click to go back to the accounts page, you’ll see your newly linked bank account, but it is under review.

What are Payoneer’s fees for withdrawing with a Dom account?

Payoneer to Payoneer Transfers

There is no fee attached for transfers within Payoneer, such as transferring funds from Payoneer to Payoneer.

Payoneer to Naira Bank Accounts

For withdrawing your funds from Payoneer to your bank accounts that are not domiciliary, there’s no fee also. However, the conversation rate may be lower since it’s not a domiciliary account.

» MORE: How To Buy Dollars With Naira And Deposit Into Your Domiciliary Account

Payoneer to Domiciliary accounts

[ads]For withdrawing your funds from your Payoneer to your domiciliary account, there is a fee of $10 if you’re withdrawing funds that are less than $500.

If you’re withdrawing funds that are up to $500 and above, an additional 1% of the funds will be added.

For example, if you have $50 on your Payoneer and want to withdraw it to your domiciliary account, $40 will be credited to your dom account since Payoneer will charge you $10.

However, if you have $500 and want to withdraw it, $490 will be credited to your domiciliary account. And if it’s $1000, $20 will be charged and $980 will be credited to your domiciliary account. And that’s how it works.

Kindly subscribe to Wiki Freelancing on YouTube to enjoy helpful and money-making strategies to make the most your freelancing, side hustle, affiliate marketing, and money-making in general.

I’m having trouble locating it but, I’d like to send you an e-mail.

Hi Maryann, shoot a mail to smart@wikifreelancing.com

I like what you guys are usually up to

This page certainly has all of the information I wanted

Hey! Do you use Twitter? I’d like to follow you if

that would be okay. I’m undoubtedly enjoying your blog and look forwad to new posts.

Your style is unique in comparison to other people I have read stuff from.

Thanks for posting when you have the opportunity

Keep up the good work! You recognize, lots of individuals are looking round for this information,

you could aid them greatly.

Helpful guide

Please how many working days will it take to reflect on my Domiciliary Account?

I made a transaction from my Payoneer to my Domiciliary Account and it has not reflected on my Dom account

When you withdraw your funds from Payoneer to your Domiciliary account, it could take about 1 hour (especially during workdays) before reflecting on your Domiciliary account. Most times, it takes less than 30 minutes. But if there’s an issue along the process, it may take much more time.

If you made a transaction from your Payoneer to your Domiciliary account, and it’s not reflected on your Dom account, you may have to wait for a few more hours or days (if weekend). If it’s your first time withdrawing to your Domiciliary account, please check to confirm that the account is functional and you linked it correctly. Feel free to update me about it.

Pls how many days will it take to reflect on your Don Account?

It’s a pity you don’t have a donate button! I’d definitely donate to

this outstanding blog!

I love your blog.. very nice

100% worked for me smoothly

I love your blog.. very nice colors

This helped me a lot

You make things easy for me all the time.